Candy Price Trends During Easter in 2024 – How the Retailers Should Deal with the Increase in Cocoa Prices

Introduction

This year, Easter egg hunts provided a new challenge for families due to soaring chocolate and candy prices. The spike is because of cocoa deficit, worsened by crop diseases and climate change affecting West African farms, which supply over 68% of the world’s total cocoa.

This “cocoa crisis” has tripled cocoa prices, impacting confectioners like Hershey’s and Cadbury. To sustain profit margins, these iconic brands consider adjusting prices, as Easter ranks among the top three candy-purchasing occasions.

Despite cocoa shortages and inflation, the National Confectioners Association predicts U.S. Easter candy sales to match or exceed last year’s $5.2 billion, driven more by price hikes than increased sales volume.

At Actowiz Solutions, our ongoing analysis of retail pricing trends, including Easter candy pricing, provides valuable insights for brand strategy and retail pricing optimization.

Analysis of Price Increase in Chocolate and Candy Prices

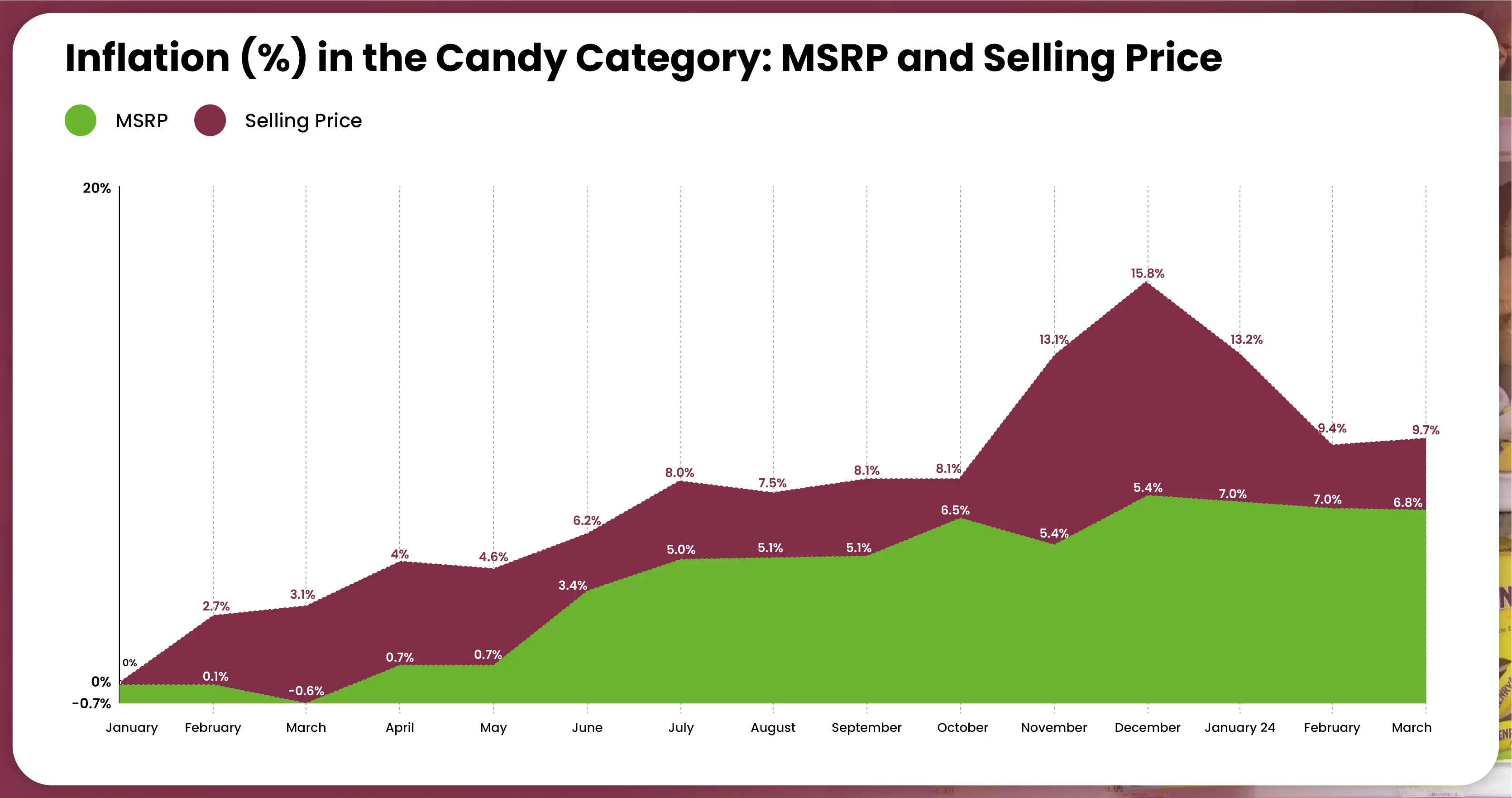

Our comprehensive study analyzed a diverse range of 3,000 products sourced from major U.S. retailers, including Amazon, Giant Eagle, Kroger, and Target. We compared price trajectories over the past 15 months to average prices in January 2023. Our analysis focused on two crucial price points: the selling price, reflecting the final cost to consumers after discounts, and the Manufacturer’s Suggested Retail Price (MSRP) set by brands. This research offers valuable insights into Easter candy pricing trends, retail pricing trends, and brand strategy through retail price analytics and historical pricing analytics.

Our analysis reveals a consistent uptrend in the average selling price, driven largely by retailer decisions, throughout 2023. By December, prices peaked at 15.2% above January 2023 figures. As of March 2024, coinciding with Easter, selling prices are approximately 9% higher compared to the previous year’s start.

Simultaneously, the Manufacturer’s Suggested Retail Price (MSRP) has shown a consistent upward trajectory, driven by rising cocoa expenses. Brands have adapted their suggested prices accordingly, with the current MSRP approximately 7% higher than its January 2023 level, peaking at a 7.1% increase by December 2023. This underscores the direct impact of escalating cocoa costs on product pricing strategies, as revealed by retail pricing insights and analytics.

Rising Costs Take a Toll on Chocolate Candy Products

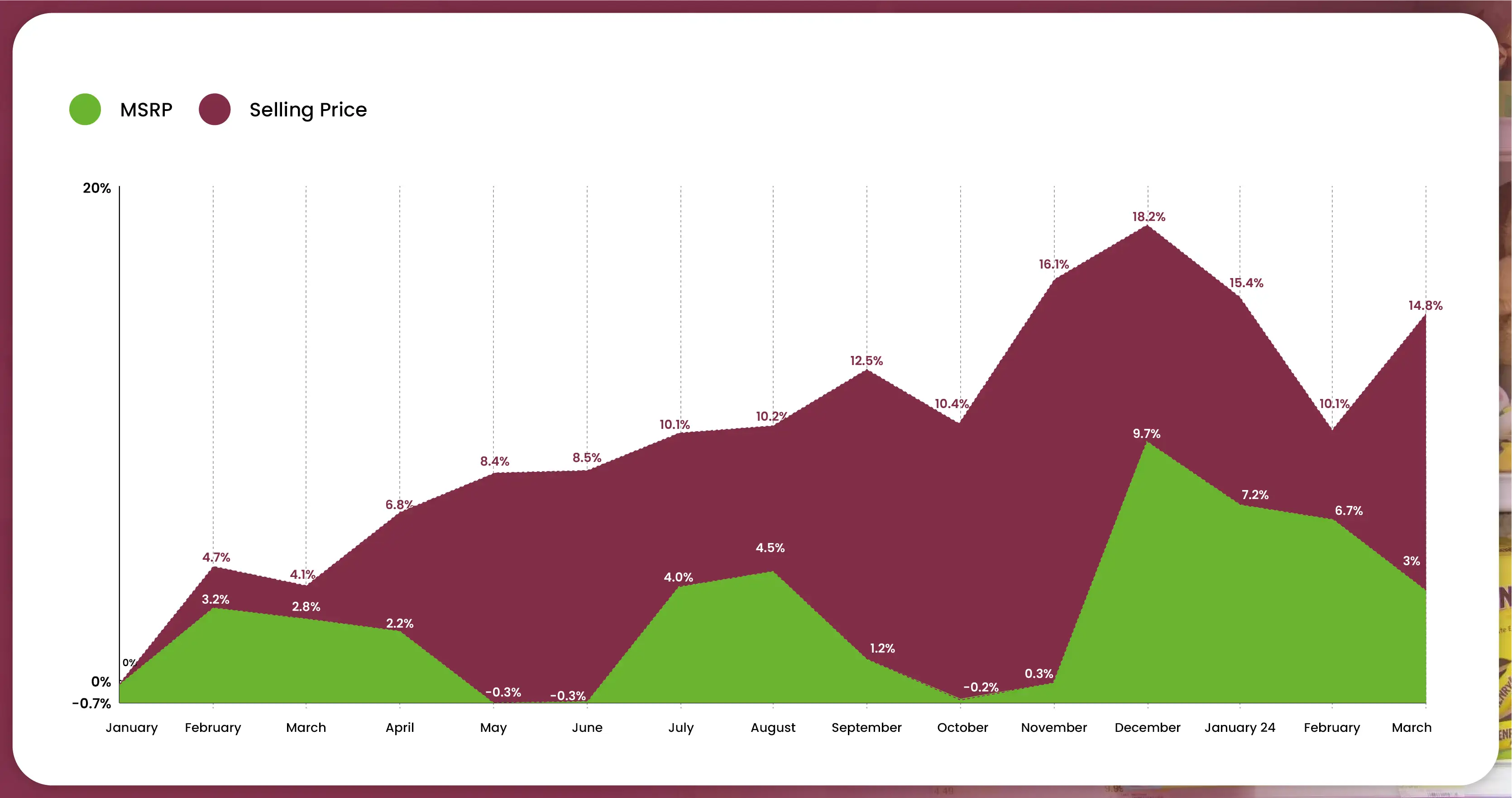

Over the last 14 months, chocolate-based candies have seen notably steeper price hikes compared to their non-chocolate counterparts.

Selling prices for chocolate items surged by 14.6%, contrasting sharply with the modest 3.9% increase seen in non-chocolate candies.

This surge was especially pronounced during the Christmas shopping season in response to increased demand, before experiencing a temporary dip in February.

The scarcity of cocoa, along with increasing expenses for packaging and transportation, has led both brands and retailers to pass on these additional costs to consumers. This phenomenon drives the unique pricing patterns seen across the candy market, with chocolate products facing the greatest impact from these cost pressures.

Retailers and Brands Offer Easter Discounts to Attract Shoppers

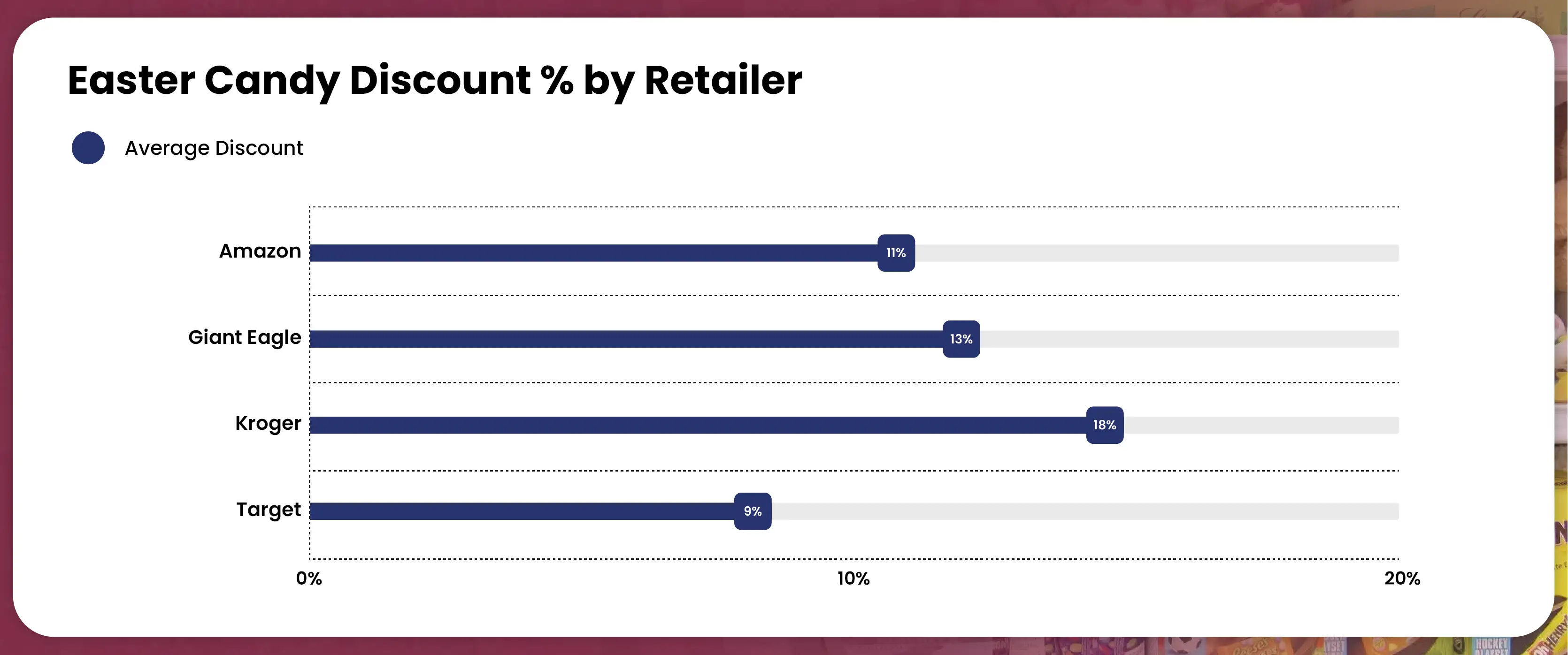

In our analysis, we conducted a detailed examination to pinpoint the retailers and brands offering the most enticing prices for Easter-themed confections, such as Chocolate Bunnies, Eggs, and Easter-themed gift packs.

Among the retailers we monitored, Kroger stood out as the leader, offering a remarkable 18% discount on Easter candies. Following closely behind, Giant Eagle boasted a substantial 13% average markdown. Meanwhile, Amazon and Target offered more conservative promotional discounts at 11% and 9%, respectively.

Kroger is actively ensuring consumers have access to attractively priced Easter treats by keeping its doors open throughout the Easter weekend. Featuring discounted items like Brach’s jelly beans, Russell Stover chocolate bunnies, Reese’s eggs, and assorted bags of popular candies from Twix, Starburst, Snickers, etc. Additionally, Kroger enhances its value proposition through gift card offers and exclusive Easter deals for loyalty program members.

On the brand side, Starburst by Mars Wrigley offers the steepest discount of 23%. Cadbury, under Mondelez, follows closely with a 20% discount on its mini eggs and other Easter treats, an increase from last year’s 15%. Ferrero Rocher makes a notable pricing move with an average 18% markdown on its Easter selections, including chocolate bunny and squirrel figures.

This year, Peeps, the cherished marshmallow candies by Just Born are offered at a 17% discount, slightly below the 22% discount seen in 2023. This decline may be attributed to the impact of increasing sugar costs, given their sugar and corn composition.

Other notable brands, such as M&M’s and the premium Swiss chocolatier Lindt, have increased their average Easter discounts to 17% this year, up from 12% and 10% respectively last year. This demonstrates a competitive pricing strategy aimed at delighting consumers this Easter season.

Managing Inflationary Pressures This Easter Season

In the current challenging retail environment, both retailers and brands face the imperative of remaining profitable and competitive amidst inflationary pressures. To navigate these challenges effectively, several strategic approaches can be adopted:

- Designing innovative combo packs that combine chocolate and non-chocolate items can cater to diverse consumer preferences and budget ranges while maintaining profit margins. This approach capitalizes on consumer interest in variety and value.

- Offering enticing discounts on larger quantities encourages bulk buying, amplifying sales volumes to offset increased costs per item and achieve economies of scale. This strategy aligns with consumer demand for cost-effective shopping solutions.

- Monitoring competitors’ pricing strategies closely is crucial. By implementing well-considered discount strategies that balance competitiveness with margin preservation, retailers and brands can capture market share effectively. Leveraging advanced pricing intelligence tools, such as those provided by Actowiz Solutions, offers invaluable insights for informed pricing decisions.

- Considering revisions to product size or weight as a cost management measure—known as “shrinkflation”—can help mitigate the impact of rising costs. Transparent communication on packaging is essential to maintain consumer trust while implementing such adjustments.

Confectioners must prioritize using these strategies to effectively handle the challenges given by the increase in cocoa prices. Concentrating on bundle offerings, optimizing pricing strategies as per competitive intelligence, incentivizing bulk purchases, and thoughtfully adjusting product sizes will be crucial. By remaining vigilant of Easter candy pricing trends, retail pricing trends, and utilizing retail pricing insights and analytics, retailers and brands can sustain competitiveness and profitability in a dynamic market environment.

For further details, contact us to speak with an expert from Actowiz Solutions today! You can also reach us for all your mobile app scraping, instant data scraper and web scraping service requirements.

SOURCES >> https://www.actowizsolutions.com/candy-price-trends-during-easter.php

Tag : #CandyPriceTrends

#CandyPricesScraping

#RetailPriceAnalytics

#EasterCandyPricingTrends

#RetailPriceScraper