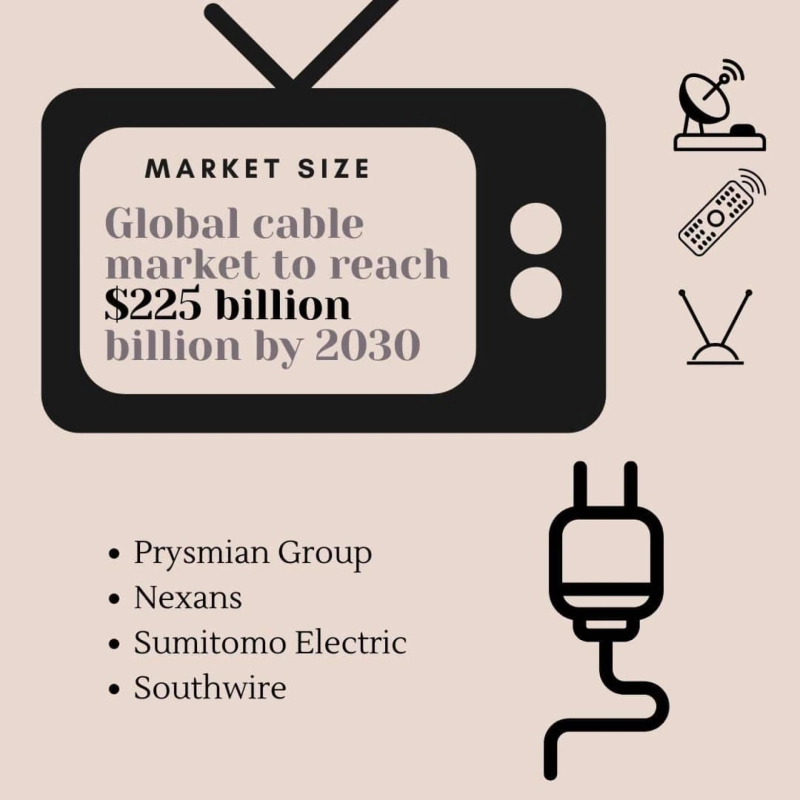

According to a recent study, the global cable market size was approximately $145 billion in 2022 and is projected to grow at a CAGR of 6.2% from 2023 to 2030, reaching over $225 billion.

According to a recent study, the global cable market size was approximately $145 billion in 2022 and is projected to grow at a CAGR of 6.2% from 2023 to 2030, reaching over $225 billion.Market Demand Drivers for cable products include

According to a recent study, the global cable market size was approximately $145 billion in 2022 and is projected to grow at a CAGR of 6.2% from 2023 to 2030, reaching over $225 billion.Market Demand Drivers for cable products include

- Rising internet & mobile data usage requiring network build outs.

- Continued growth in construction of residential and commercial buildings.

- Investments in upgrading ageing electrical grid infrastructure.

- Increasing renewable energy projects requiring cable connections.

- Proliferation of internet-connected devices and need for robust data cabling.

Recent Industry Developments

- Major cable companies are rapidly deploying fiber-optic and 5G networks to offer multi-gigabit internet speeds.

- New subsea cable projects are underway to boost global internet bandwidth.

- Aluminium cables are gaining share versus copper for some applications due to lower costs.

- Vendors are innovating with products like mini data centre cabling to enable edge computing.

Top Players in Cable Market Landscape

- Prysmian Group (11% share, $12B revenue): A global leader supplying energy, telecom, and fiber optic cables. Leveraging M&A and vertical integration strategy.

- Nexans (7% share, $7.5B rev): Focuses on cables for building, utilities, industrial applications. Targeting high-value market segments.

- Sumitomo Electric (4% share, $4.2B rev cabling): Diverse portfolio includes auto wires plus info & energy cables. Strength in Asia markets.

- Southwire (3% share, $6.5B rev): A leading North American wire and cable maker investing in new capacity and products.

- General Cable (2% share, $3.7B rev): Recently acquired by Prysmian. Solid market position in North America.

Other major players include LS Cable & System, Furukawa Electric, Leoni, Fujikura, and Far East Cable.

Strategic Positioning

Top vendors are employing strategies like

- Vertical integration into raw materials like aluminium and optical fiber.

- Developing higher performance cabling products (e.g. fire-resistant, underwater).

- Tailored solutions for focus industries like energy, telecoms, construction.

- Geographic expansion into emerging markets.

- Selective M&A to gain capabilities and cable industry.

Market Segmentation of Cable Industry

The Cable Market is majorly Segmented by these:

Power Cables - $52 billion (36% share)

- Overhead Transmission Cables: $18.5 billion

- Underground Distribution Cables: $21 billion

- Building Wires & Cables: $12.5 billion

Telecom Cables - $49 billion (34% share)

- Fiber Optic Cables: $18.2 billion

- Copper Twisted Pair Cables: $16.5 billion

- Coaxial Cables: $14.3 billion

Data Cables - $43.5 billion (30% share)

- Ethernet Cables: $19.8 billion

- USB Cables: $9.2 billion

- AV/Consumer Cables: $8 billion

- Other Data Cables: $6.5 billion

Challenges, Opportunities and Trends in the Cable Market

Challenges:

Raw Material Volatility - Cable manufacturing relies heavily on inputs like copper, aluminium, insulating materials and optical fiber. Prices for these raw materials can fluctuate considerably, impacting profitability.

Supply Chain Disruptions - The cable industry has intricate global supply chains that can be vulnerable to disruptions from events like the COVID-19 pandemic, geopolitical tensions, port congestion, etc.

Chinese Competition - Low-cost cable manufacturers, especially from China, provide aggressive pricing competition in certain segments like building wire and fiber optic cables.

Cyclical Demand - Much of the demand for cable products is tied to cyclical construction markets for residential, commercial and infrastructure projects which can decline during economic downturns.

Technical Disruption - Wireless technologies like 5G and satellite internet could theoretically make some telecom/data cabling obsolete over the very long-term, though deployment will take decades.

Opportunities:

5G & FTTx Deployments - Nationwide build outs of 5G mobile and fiber-to-the-home/premises networks are driving major new demand for fiber optic and high-speed data cables.

Electric Vehicle Growth - The proliferation of electric vehicles will require upgrading residential and public charging infrastructure, boosting demand for electrical and data cables.

Renewable Energy Projects - Major investments in solar, wind and other renewable electricity sources will necessitate installations of new transmission cables to connect to the grid.

Smart Building/City Demand - Next-generation buildings and smart city projects incorporate vast data cabling for connectivity, energy management, security and other applications.

Emerging Market Growth - There are tremendous long-term opportunities in developing markets like India to build out robust national cable-based communications and electrical networks.

Market Trends:

Aluminum Cable Adoption - With high copper prices, aluminium cabling solutions are gaining interest as a more affordable option for certain stationary power applications.

Miniaturisation of Data Cables - Ongoing innovations in miniaturised, high-density cabling to support edge computing and IoT deployments.

Subsea Cable Expansion - Major new subsea fiber optic cable initiatives are underway to upgrade global internet bandwidth between continents.

Shift to HVDC Transmission - There is a transition towards high voltage direct current (HVDC) cables for more efficient bulk transmission over very long distances.

Vertical Integration Moves - Major cable manufacturers are vertically integrating across raw materials like copper, aluminium and fiber optic strands to enhance supply and margins.

Advanced Cable Tech - Producers are investing in higher performance cable innovations like compact robotics cables, fire-resistant cables, underwater cables, etc.

Conclusion

Despite headwinds like raw material costs and competition, the cable market outlook remains robust through 2030 and beyond. Driven by megatrends like 5G/FTTx, electric vehicles, renewable energy and smart infrastructure, analysts project a $225 billion+ market by 2030 - representing 6-7% annual growth for this vital connectivity infrastructure.