Inflations Impact on US eCommerce: Analyzing Pricing and Stock Trends Through Apparel Data Scraping

The apparel industry is gradually recovering after experiencing almost two years of upheaval due to the pandemic. As the industry adapts to a new normal, retailers and manufacturers embrace eCommerce to meet changing consumer preferences. Apparel data scraping can provide valuable insights into pricing strategies, assortment planning, and consumer trends. According to eMarketer, the US fashion industry was valued at $450 billion in 2021 and is projected to reach $475 billion by the end of 2022. To stay competitive and maximize profits, many US retailers are reducing in-store expenses and enhancing their online offerings.

Fashion Retail Strategies Amid US eCommerce Growth and Inflation Challenges

The rise in online shopping is driving the growth of the fashion retail business in the US. Apparel eCommerce has been experiencing consistent annual growth, now accounting for approximately 25% of total online retail sales in the country. Strategies such as active social media engagement, the development of user-friendly online platforms, competitive pricing tactics, and fashion data scraping have all contributed to the expansion of e-retailers’ consumer bases in a highly competitive market. However, the looming threat of inflation in the US poses a significant challenge to the industry.

In 2021, the holiday shopping season in the robust US economy was characterized by high demand and supply chain disruptions, leading to empty store shelves. However, concerns over excess inventory and declining sales have arisen in 2022 due to inflation. The increasing inflation rates are significantly impacting economies worldwide, including the US. According to a Reuters report, rising inflation has decreased US consumer spending on clothing, resulting in an accumulation of inventory and a widening gap between supply and demand. The report also states that American consumers spent less in September 2022 than in the previous month due to rising prices across various categories, including food and technology. Retail data scrapingcan provide valuable insights into these trends and help businesses adapt to changing market conditions.

For retailers and brands, inflation can lead to disruptions in cash flow, high storage costs, excess inventory, lower revenues, and reduced margins. To navigate this inflationary environment, fashion and apparel players need retail data scraping services to adopt more agile and versatile pricing strategies. It can be achieved by leveraging advanced pricing and assortment management technologies. Retailers must have a thorough understanding of their market position and the competitive landscape to effectively implement their retail strategy, especially as eCommerce and omnichannel retail continue to grow.

To address this challenge, competitive intelligence solutions can provide retailers with the competitive advantage by offering accurate, timely, and actionable insights into competitive pricing and assortment. These solutions provide retailers with detailed pricing information on millions of products across multiple competitors, enabling them to make informed decisions and stay ahead in a rapidly changing market.

Insights into the US Apparel Industry

Inflation has significantly influenced consumer behavior, prompting them to become more discerning in their shopping habits. With easy access to comparison tools, customers now compare prices, delivery options, and discounts across retailers, enhancing their overall shopping experience. This trend emphasizes retailers’ importance in maintainingcompetitive pricing to retain customers.

Moreover, it is crucial to analyze whether inflation affects all retailers uniformly or if retailers respond to inflationary pressures in distinct ways.

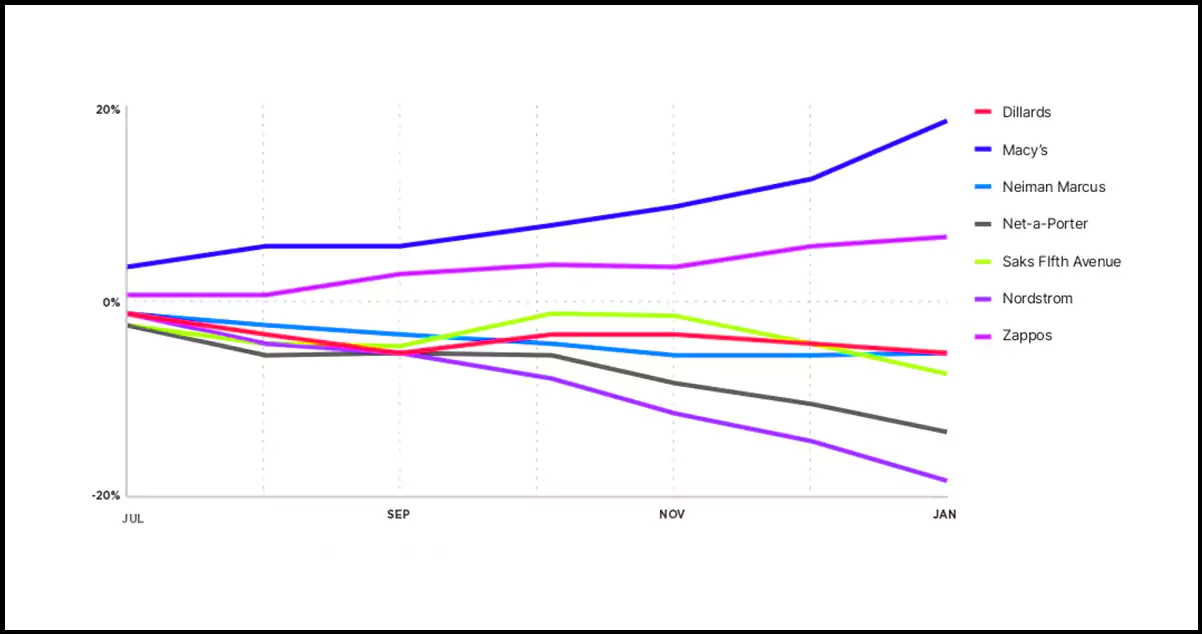

Our data analysis reveals that Nordstrom, Net-a-Porter, Saks Fifth Avenue, Neiman Marcus, and Dillard have consistently reduced their prices over recent months. By January 2023, their prices were approximately 20%, 16%, 9%, 7%, and 7% lower, respectively, compared to June 2022.

Adapting to Shifting Consumer Behavior: Pricing Strategies in the Apparel Industry

The current economic climate, characterized by inflation and changing consumer priorities, has led to shifts in purchasing behavior, particularly in the fashion and apparel sector. Nordstrom’s recent experience highlights this trend, as despite price reductions, sales remained stagnant. It can be attributed to consumers prioritizing essential purchases over discretionary spending on fashion items.

Nordstrom’s Annual Report acknowledged this trend, noting that economic downturns or inflationary periods reduce customer spending on discretionary items, leading to lower sales and potentially higher markdowns. In response, apparel companies focus on driving sales through eCommerce platforms, even if it means operating in a more promotional environment and sacrificing profit margins.

In contrast, Macy’s and Zappos have taken a different approach by gradually increasing their prices. This strategy has resulted in prices being 18% and 6% higher in January 2023 compared to June 2022.

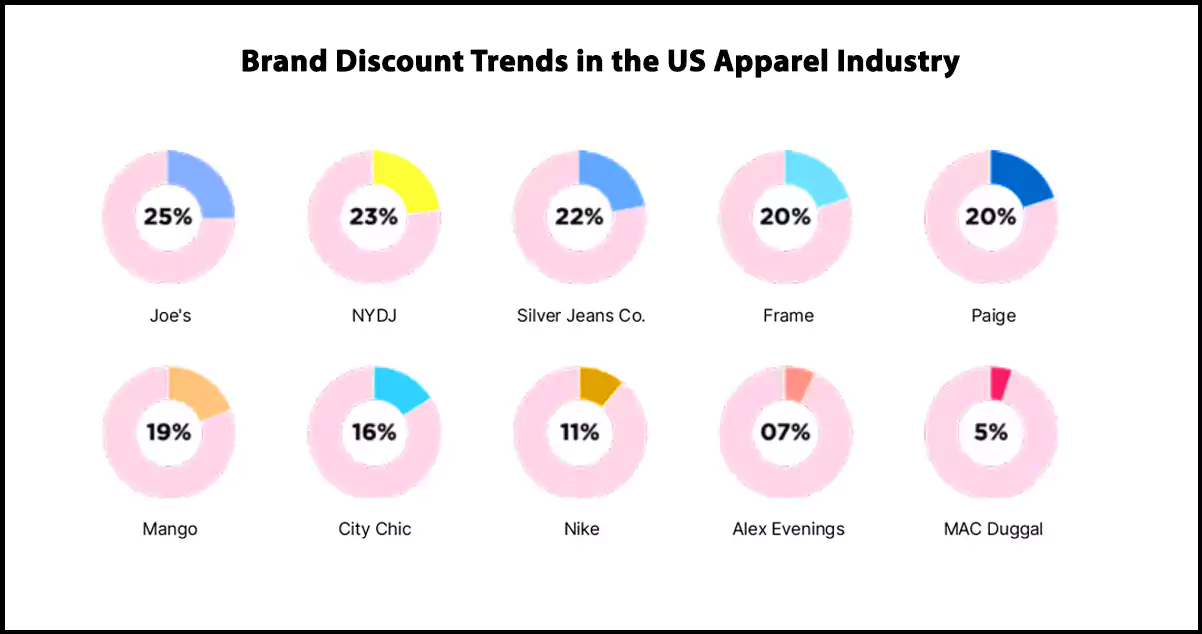

Notably, pricing strategies are not limited to retailers but impact brand manufacturers’ selling in marketplaces. Our data indicates that many US apparel brands have maintained healthy discount levels to manage higher inventories and softer market demand. By tracking the average discount over the last 7 months, we observed how brands adapt to current market conditions.

Brand Discount Trends in the US Apparel Industry

In examining discount trends among various apparel brands, it’s evident that while some brands like MAC Duggal and Alex Evenings maintained low discount levels of 5-7%, most offered discounts exceeding 15%. Notably, Joe’s, NYDJ, and Silver Jeans Co. were among the brands with the highest discounts, offering discounts as steep as 28%, 25%, and 22% respectively.

A deeper dive into the data revealed that several brands increased their discount levels incrementally each month from July 2022 to January 2023. Brands such as Mango, Paige, Frame, and Silver Jeans Co. saw their discounts grow by 18%, 16%, 13%, and 12% respectively over this period. This trend suggests a strategic approach by these brands to adapt to market conditions and consumer behavior, aiming to maintain competitiveness and drive sales.

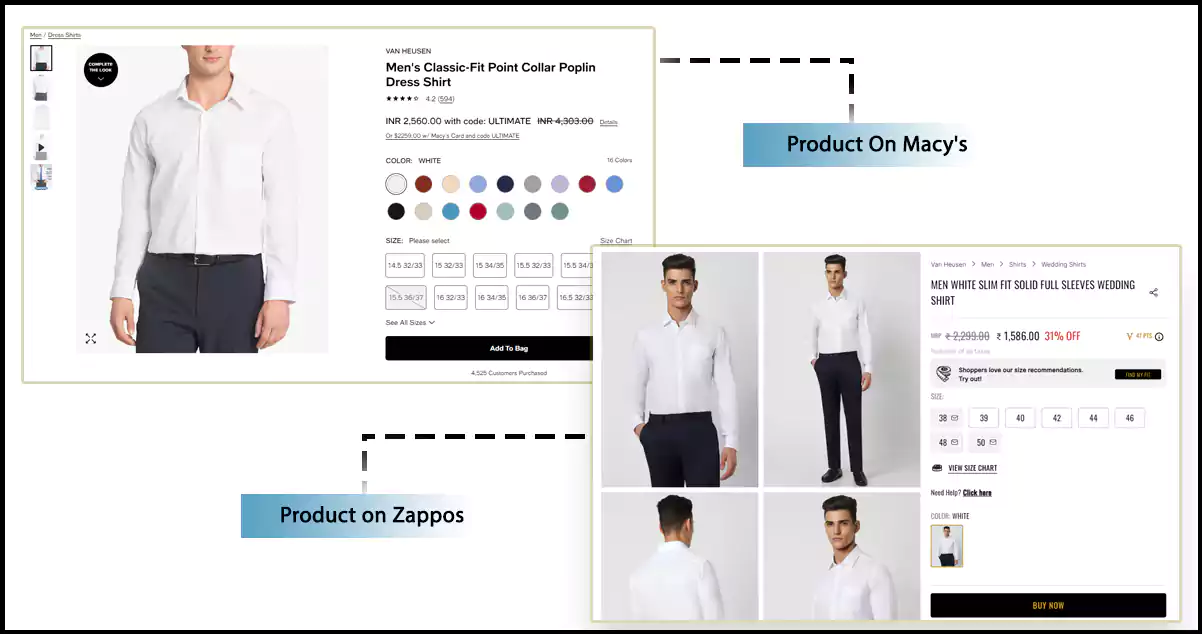

Enhancing Competitive Edge in Apparel Retail: The Role of Product Matching

In the fiercely competitive landscape of fashion and apparel retail, understanding how one’s product pricing compares to competitors is paramount. This knowledge can reveal opportunities to either lower prices to gain a competitive edge or increase prices without compromising on being the lowest-priced option.

However, achieving this level of insight requires the ability to match products across different websites accurately. This process is often challenging due to websites’ varying titles, descriptions, and images. Once products are successfully matched, retailers can aggregate prices at the desired frequency, providing real-time insights into their competitive pricing positions.

In the fashion industry, consumers often search for equivalent or similar products rather than identical ones. Therefore, it is essential to identify and match the same products and find similar products across websites. Advanced product matching technology enables this capability, which can identify and match exact and similar products from various web sources.

For instance, this technology can match two white shirts from different brands based on their similarity in color, type, sleeve length, collar type, price range, and other attributes. This enables retailers to compare their pricing not only against identical products but also against substitutes offered by competitors, providing a comprehensive view of the competitive landscape at scale.

Navigating Supply Chain Dynamics in the Apparel Retail Sector

The apparel industry is currently grappling with inventory challenges stemming from disruptions in the supply chain. These disruptions, which originated in 2022, resulted in many holiday shipments being delayed until the spring. This delay coincided with rising inflation, prompting customers to reduce their spending on non-essential items like fashion and apparel.

To manage the situation, retailers began canceling orders to prevent the accumulation of excess merchandise. Additionally, stores have increased the breadth and depth of their discounts to entice inflation-conscious shoppers and stimulate demand.

A recent report by Global Trade Daily revealed that in the third quarter of 2022, the average inventory held by the US’s 20 largest public apparel firms surged by 28% to reach US$2.1 billion compared to pre-pandemic levels in 2019.

Maintaining product availability is crucial in such a dynamic market, especially when catering to a diverse consumer base with varying product preferences. Effective inventory management can help fashion and apparel retailers meet demand while preserving their competitive edge in the market.

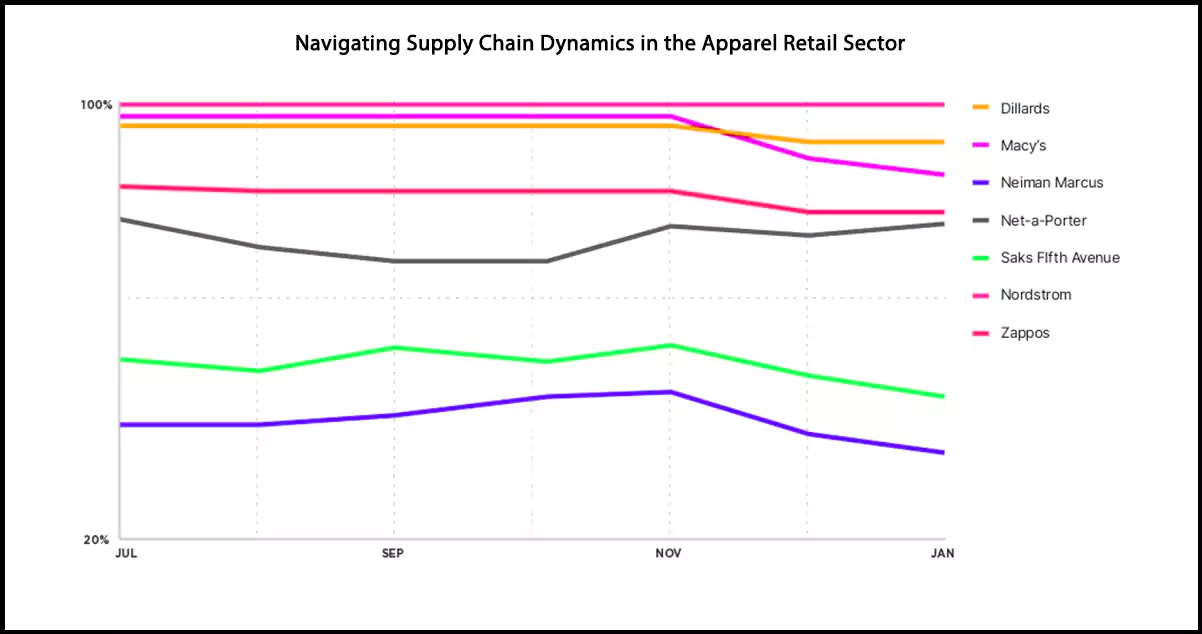

Analyzing Stock Availability Trends in Apparel Retailers

Our analysis of various retailers aimed to understand how their stock availability has changed since July 2022. Nordstrom stood out by maintaining close to 100% stock availability consistently throughout the period under review.

Nordstrom: Consistently maintained close to 100% stock availability.

Dillards, Macy’s, and Zappos: Experienced a decline from 99%, 97%, and 88% in July 2022 to 88%, 94%, and 82% in January 2023, respectively, indicating pressure from supply chain disruptions. However, these levels are significantly better than during the COVID-19 pandemic.

Saks Fifth Avenue (48-57% availability) and Neiman Marcus (38-49% availability): These retailers face challenges in maintaining healthy stock levels, indicating ongoing supply chain struggles.

Nordstrom’s recent annual report highlights their focus on building new supply chain capabilities to enhance inventory management and improve customer-facing technology. This includes the Closer to You strategy, which aims to provide greater inventory availability between digital and retail locations.

Despite bringing in new supply chain chiefs early in 2022, Neiman Marcus faces stock availability challenges. This may result from the company’s post-pandemic strategy to focus on its top 2% of customers, who contribute significantly to its total sales.

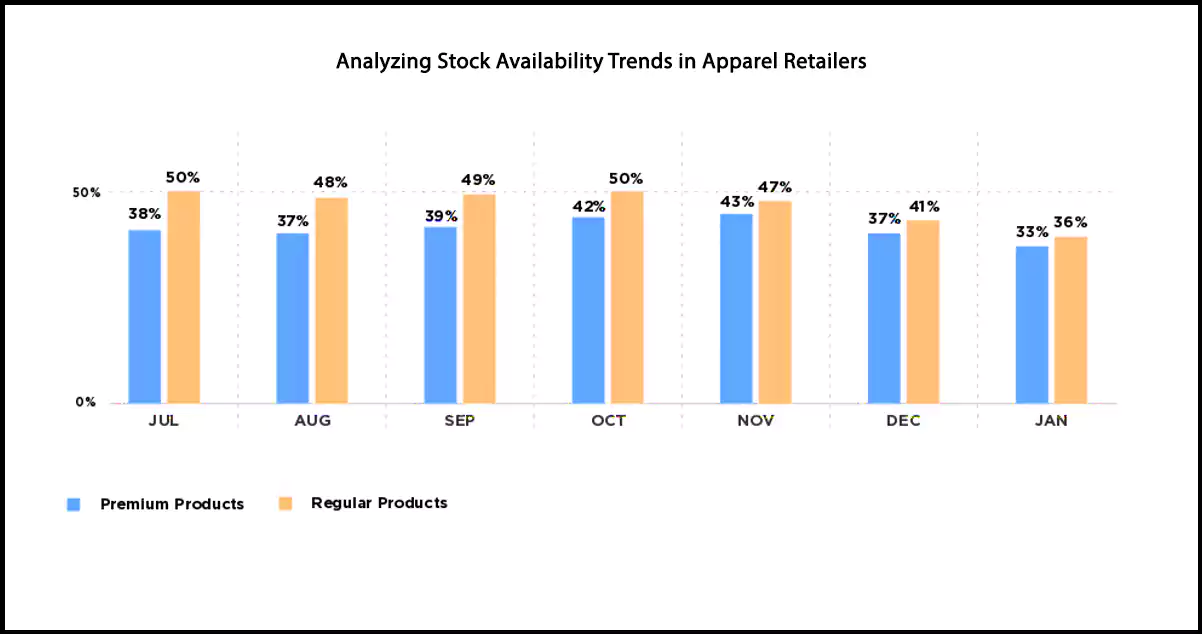

In our analysis, we also looked at the difference in stock availability between Neiman Marcus’s premium products (top 20 percentile by price) and their regular assortment, providing insights into how retailers manage stock levels across different product categories.

Navigating Challenges and Embracing Opportunities in Apparel Retail

To thrive in the face of inflationary pressures and evolving consumer buying patterns, fashion and apparel retailers must implement comprehensive pricing, merchandising, and supply chain strategies. Enhancing eCommerce capabilities is crucial for staying competitive and maximizing profits in today’s market.

Retailers should leverage technologies that enable them to monitor their competitive pricing positions across various parameters such as product categories, brands, and price levels. This data-driven approach helps identify opportunities to optimize pricing, increasing revenue and maximizing margins. Additionally, having insights into other key sales drivers like stock availability, assortment strengths and weaknesses, delivery fees, and times is essential.

As highlighted in this report, retailers and brands employ diverse strategies to outperform their competitors, reflecting their unique challenges. Success in the competitive eCommerce landscape requires a deep understanding of these strategies and the ability to predict and respond effectively.

Moreover, given the dynamic nature of macroeconomic factors and consumer behavior, apparel retailers must have access to real-time competitive and market insights to make informed decisions and adapt swiftly to changing market conditions.

Discover unparalleled web scraping service and mobile app scraping services offered by iWeb Data Scraping. Our expert team specializes in diverse data sets, including retail store locations data scraping and more. Reach out to us today to explore how we can tailor our services to meet your project requirements, ensuring optimal efficiency and reliability for your data needs.

know more>>https://www.iwebdatascraping.com/us-ecommerce-inflation-analysis-apparel-data-scraping.php

tag: #ApparelDataScraping,

#ExtractApparelData,

#ExtractApparelDataUSECommerce,

#ApparelDataScraper,

#ScrapeApparelData,

#ApparelDataCollection,

#ApparelDataExtraction,