Mastering CFD Trading: A Comprehensive Guide

Introduction

Contracts for Difference (CFDs) have emerged as a popular derivative trading instrument in recent years, offering traders an opportunity to speculate on price movements across various financial markets. This versatile financial product allows traders to profit from both rising and falling markets, making it a powerful tool in the hands of informed investors. In this guide, we will delve into the world of CFD trading covering everything from the basics to advanced strategies.

Understanding CFDs

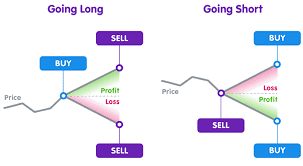

A Contract for Difference is essentially an agreement between a buyer and a seller to exchange the difference in the value of an underlying asset at the contract’s initiation and termination. Unlike traditional investing, CFD trading does not involve the physical ownership of the underlying asset, allowing for greater flexibility and leverage.

Advantages of CFD Trading

Leverage: CFDs allow traders to gain exposure to a larger position than their initial capital outlay. This amplifies both profits and losses, making it crucial for traders to implement risk management strategies.

Diverse Asset Classes: CFDs cover a wide range of assets including stocks, indices, commodities, currencies, and cryptocurrencies, providing traders with a plethora of options to choose from.

Short-Selling Opportunities: CFDs enable traders to profit from falling markets by taking short positions, allowing for a more comprehensive trading strategy.

Hedging Possibilities: CFDs can be used as a hedging tool to offset potential losses in an existing portfolio, providing a level of protection during volatile market conditions.

No Stamp Duty or Ownership Costs: Since CFD traders do not own the underlying asset, they are exempt from certain costs such as stamp duty or storage fees associated with traditional investments.

Risks and Risk Management

While CFD trading offers significant opportunities for profit, it also carries a high level of risk. It is crucial for traders to implement effective risk management strategies to mitigate potential losses. Some essential risk management techniques include setting stop-loss orders, diversifying the portfolio, and avoiding over-leveraging.

Choosing the Right CFD Broker

Selecting the right CFD broker is a critical step in ensuring a successful trading journey. Consider factors such as regulatory compliance, trading platform functionality, available assets, spreads and commissions, customer support, and educational resources before making a decision.

Technical and Fundamental Analysis

To make informed trading decisions, it’s essential to utilize both technical and fundamental analysis. Technical analysis involves the study of historical price charts and indicators to identify potential entry and exit points. Fundamental analysis, on the other hand, focuses on the underlying factors that influence an asset’s value, including economic indicators, earnings reports, and geopolitical events.

Developing a Trading Strategy

A well-defined trading strategy is the cornerstone of success in CFD trading. Traders should determine their risk tolerance, preferred trading style (day trading, swing trading, or position trading), and the assets they want to focus on. Additionally, they should establish clear entry and exit criteria and adhere to them rigorously.

Advanced CFD Trading Strategies

Pairs Trading: This strategy involves trading two correlated assets simultaneously, taking advantage of their relative price movements. When one asset outperforms the other, traders can profit from the spread.

Hedging with CFDs: Traders can use CFDs to hedge their existing portfolios, providing a safeguard against potential losses during market downturns.

Scalping: Scalpers aim to profit from small price movements by executing a large number of trades within a short period. This strategy requires a keen understanding of market dynamics and quick execution.

Conclusion

CFD trading offers a versatile and dynamic platform for traders to profit from various financial markets. By understanding the fundamentals, implementing effective risk management, and developing a well-thought-out trading strategy, individuals can navigate this exciting arena with confidence. Remember, success in CFD trading requires continuous learning, discipline, and a willingness to adapt to changing market conditions. Happy trading!